Lending Protocol Data

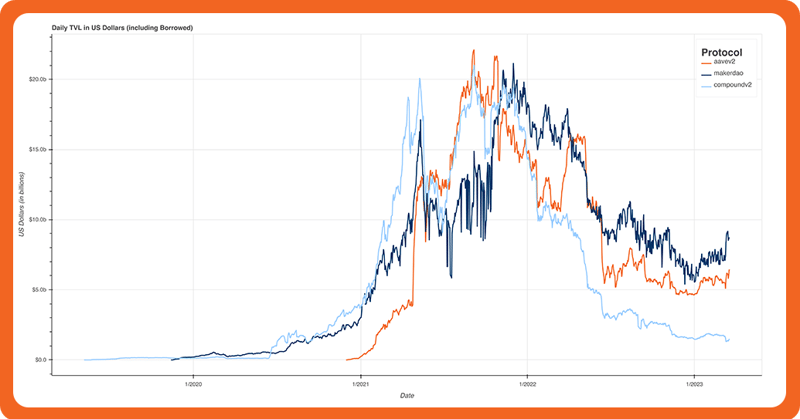

Amberdata has the largest multi-chain coverage of historical and real-time data for the most active lending protocols. Financial institutions can leverage deep metrics and insight into the entire world of DeFi lending.

Multi-Chain Lending and Borrowing Protocol Aggregations

Lenses into Lending Protocols

✅ Latest and historical data, normalized and sourced directly from the blockchain

✅ One singular API for all DeFi lending protocols

✅ Standardized multi-chain data

✅ Granularity as low as 1s

Learn MoreGenerate Lending Protocol Visualizations

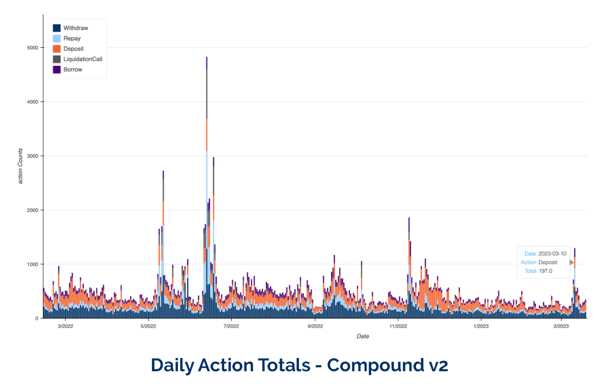

Get multi-chain exposure and generate visualizations of critical protocol actions including borrows, deposits, supplies, repayments, withdrawals, reserve as collateral, liquidations, and flash loans.

Manage Your Lending Portfolio

Analyze the historical returns for an individual wallet across multiple DeFi lending protocols and understand a wallet’s performance over time, net worth, and yield from interest earned.

.png?width=800&height=420&name=Lending%20Profit%20and%20Loss%20Analytics%20(1).png)

Use Cases

Generate Alpha

-

Access a user's wallet movement, balances, loan health ratings, and historical profits and losses.

-

Backtest deep history and enable real-time intelligence that mimics traditional finance data.

-

Analyze interest rates offered by various DeFi lending protocols and select the most favorable rates.

-

Identify and mimic successful liquidity provider strategies.

Manage Protocol Risk

- Mitigate risk with access to every transaction across the growing DeFi landscape.

- Manage portfolios and balance sheets.

- Model decentralized lending platforms and DEX volatility exposures.

Build Accounting Best Practices

-

Get access to profits and losses related to every activity on-chain.

-

Provide detailed accounting for asset movement on a DEX or lending protocol.

-

Support compliance by monitoring crypto loans, pools, and liquidity providers.

Generate Alpha

-

Access a user's wallet movement, balances, loan health ratings, and historical profits and losses.

-

Backtest deep history and enable real-time intelligence that mimics traditional finance data.

-

Analyze interest rates offered by various DeFi lending protocols and select the most favorable rates.

-

Identify and mimic successful liquidity provider strategies.

Manage Protocol Risk

- Mitigate risk with access to every transaction across the growing DeFi landscape.

- Manage portfolios and balance sheets.

- Model decentralized lending platforms and DEX volatility exposures.

Build Accounting Best Practices

-

Get access to profits and losses related to every activity on-chain.

-

Provide detailed accounting for asset movement on a DEX or lending protocol.

-

Support compliance by monitoring crypto loans, pools, and liquidity providers.